Important announcement by Chief Minister Vijaybhai Rupani Decision to give loan up to one lakh rupees.

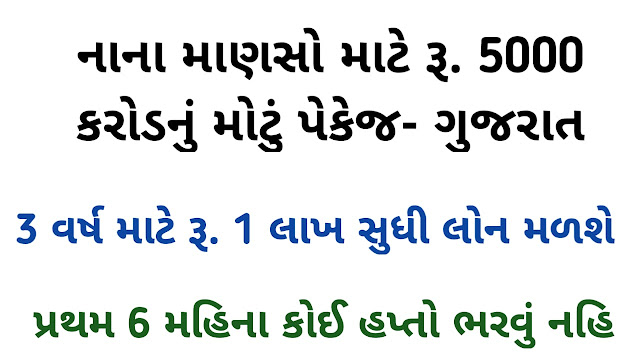

The Gujarat government today made an important announcement for small traders. Chief Minister Vijay Rupani has announced his ‘Self-reliant Gujarat’ scheme through Facebook. Let us know what the provision is.

Join Whatapp Group for latest updates: Click here

● Government of Gujarat announces self-reliant Gujarat assistance scheme

● More than 10 lakh people in the state will benefit from the scheme

● Loans up to Rs 1 lakh will be given to artisans and traders

Gujarat Government has announced ‘Atmanirbhar Gujarat’ scheme. More than 10 lakh people in the state will benefit from this scheme. Loans up to Rs 1 lakh will be given to artisans and traders. The interest on this loan will be charged only 2% instead of 12%. Based on the application without any guarantee Rs. Loans up to Rs 1 lakh will be available.

Loans to small traders at 6 per cent

The state government will pay 6 per cent interest to small traders. No installment remains to be paid for six months. Cooperative banks have also agreed to help. People will be able to become self-reliant if money falls into their hands. This system will be built in every corner of Gujarat.

Key points of the plan

1. More than 10 lakh people in the state will benefit from the scheme

2. Loans up to Rs 1 lakh will be given to artisans and traders

3. Loans will be available at only 2 per cent instead of 12 per cent

4. Loans up to Rs 1 lakh will be given depending on the application

5. The state government will pay 6 per cent interest on loans to small traders

6. No installment remains to be paid for six months

7. Cooperative banks have also agreed to help

Important Link↙️

Significantly, PM Modi announced a Rs 20 lakh crore package with a self-reliant India during his national address on Tuesday. In this regard, the Rupani government also announced a self-reliance scheme.

Ahmedabad: The Gujarat government on Thursday announced a scheme under which people in lower middle income group can avail guarantee-free loan of Rs 1 lakh from banks at 2 per cent annual interest as it seeks to help them get back to normal life disrupted by the COVID-19 lockdown. The government will pay another 6 per cent interest to banks giving loan under the scheme, Atmanirbhar Gujarat Sahay Yojna (AGSY), targetted at small businessmen and a cross- section of people falling under the lower middle income group.

According to scheme norms, while the tenure of loan will be three years, payment of installments will begin only after six months of disbursal.

The central government has given a package of Rs 20 lakh crore to make India ‘atmanirbhar’ (self-reliant). The state government has also decided to launch Atmanirbhar Gujarat Sahay Yojna (AGSY) for small businessmen, skilled workers, autorickshaw owners, electricians and barbaers, among others,” Chief Minister Vijay Rupani said.

- Other states have declared assistance of Rs 5,000 or so to such people. However, we are of the opinion that such a small amount will not bring their life back to normal, he said.

- “Around 10 lakh such people will be given loan of Rs 1 lakh each from banks at just 2 per cent annual interest to start their lives afresh, Rupani said.

- Loans will be provided on the basis of application where no guarantee will be required, he said.

- The state government will pay the remaining 6 per cent interest on loan to banks. The tenure of such loans will be three years. Re-payment of principal and interest will start after six months of sanction, he said.

- The government has come up with this scheme after discussion with district, scheduled and cooperative banks, the chief minister said.

The state government will come out with detailed information on AGSY in a few days and loan will be made available to all those who are in need of it, he said.